Global Loan Servicing Software Industry: Key Statistics and Insights in 2024-2032

Summary:

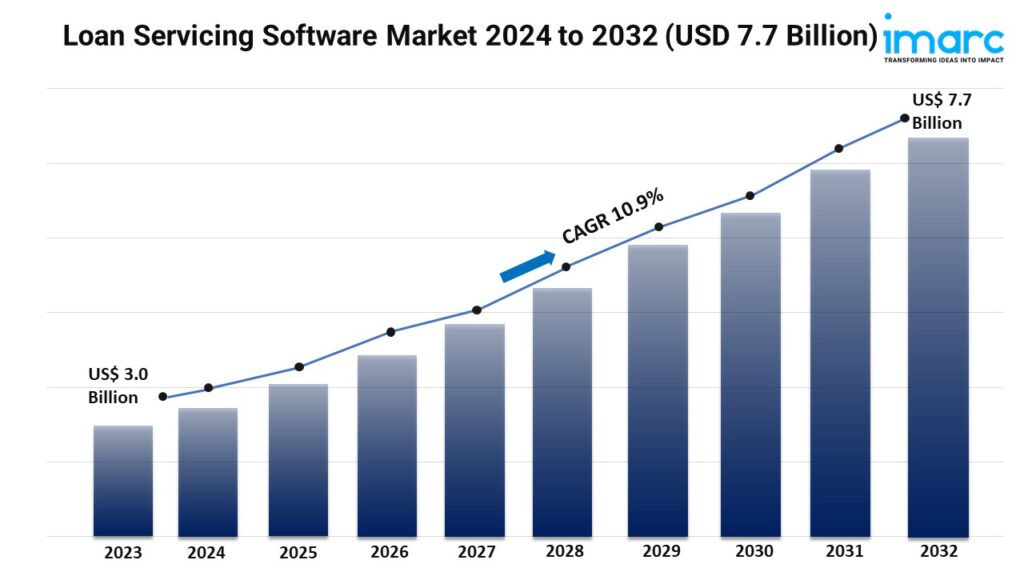

The global loan servicing software market size reached US$ 3.0 Billion in 2023.

The market is expected to reach USD 7.7 Billion by 2032, exhibiting a growth rate (CAGR) of 10.9% during 2024-2032.

North America leads the market, accounting for the largest loan servicing software market share.

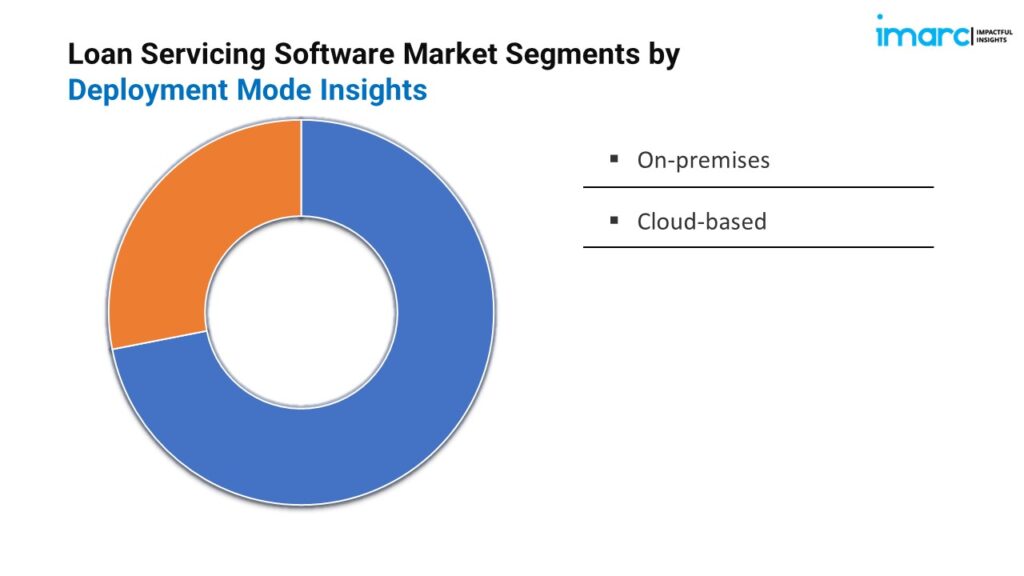

The majority of the market share is cloud-based due to user happiness, increased accessibility, and reliability anytime, anywhere.

The largest segment is software, which is characterized by data accuracy, error reduction, and time savings.

Loan servicing software saves money and time by regulating cash flow, preventing unnecessary losses, and lowering annual financial expenses.

Automating difficult calculations lowers computational mistakes. Loan servicing software manages faults that might be costly to the firm.

Loan Servicing Software Market Trends and Drivers:

Growing Revenues for The Company:

Loan servicing software helps to save money and time as software regulates the cash flow to avoid inappropriate losses and lowers the annual financial expenses. It tracks the payment and collection, which directly impacts the revenue of the company. It notifies the servicer about due dates, payments, and offline collection. Besides this, the growing revenues of the company due to loan servicing software is offering a favorable market outlook.

Ensuring Accuracy:

The automation of complex calculations reduces computational errors. The errors that can cost a lot for the organization are managed by the loan servicing software. It also ensures accuracy in calculating interest and repayments. In addition, loan servicing software gives correct data of the company and extracts the right information in real-time whenever required. It gives accurate results and simplifies many aspects for the employees. It maximizes the tools and automation to lower the risk of such errors.

Improving Consumer Experiences:

Personalized communication between consumers and software serves to improve transparency and build trust through customized interactions. The customizable dashboards and targeted notifications demonstrate attentiveness. It keeps people well-informed about their loan applications. It offers them mobile access and self-service choices and increases client satisfaction. It also provides online chat support and helpline numbers to mitigate potential issues of users. Moreover, the increasing need to improve user experience is impelling the market growth.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/loan-servicing-software-market/requestsample

Loan Servicing Software Market Report Segmentation:

By Deployment Mode:

On-premises

Cloud-based

Cloud-based accounts for the majority of the market share owing to user satisfaction, enhanced accessibility, and reliability anytime from anywhere.

By Enterprise Size:

Large Enterprises

Small and Medium-sized Enterprises

Large enterprises exhibit a clear dominance in the market on account of the large amount of enterprise data, which can be managed by loan servicing software as compared to manual loan-servicing duties.

Regional Insights:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America enjoys the leading position in the market, driven by the growing utilization of digital services to offer loans to people.

Top Loan Servicing Software Market Leaders:

The loan servicing software market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

Altisource

Applied Business Software

Bryt Software LCC

C-Loans Inc.

Emphasys Software (Constellation Software)

Financial Industry Computer Systems Inc.

Fiserv Inc.

GOLDPoint Systems Inc.

Graveco Software Inc.

LoanPro

Nortridge Software LLC

Q2 Software Inc. (Q2 Holdings Inc.)

Shaw Systems Associates LLC

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145